Federal contractors are asking the urgent question, when do solicitation releases begin in earnest? Given the nature of the Trump administration, some contractors fear there is a jinx on procurement this year.

This article is written to assess the question, what will proposal activity be like in 2017? It looks at trends and indicators to make a probable analysis.

Many of us recall the @#%^&* delays in RFP releases in 2001 when George W. Bush took office. Defense secretary Donald Rumsfeld had decided to make “a top-to-bottom overhaul” of the DoD, and contractors were cursing his name, because it seemed like solicitations would never be released.

Key Questions

Under President Trump, some of the questions in the minds of the bidders are these:

- How does having the appropriations passed later than at any time in the 21st century affect releases?

- Does not having many of the political appointees onboard slow things down?

- Would a possible impeachment throw a wrench into the machinery?

Empirical Evidence on the Proposal Pattern

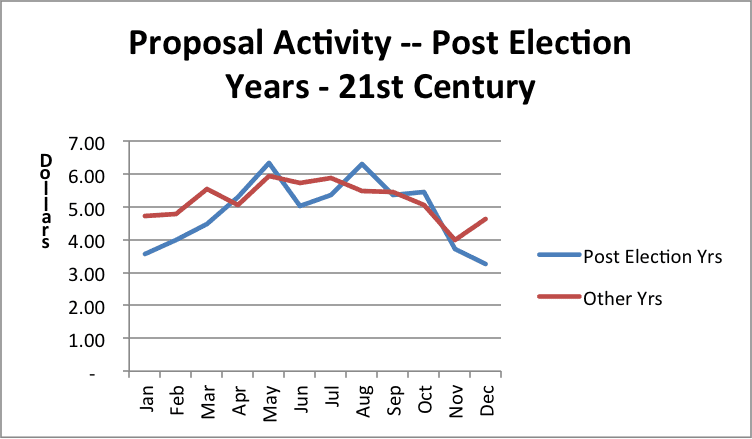

BEFORE we look at the three questions shown above, it would be helpful to first examine some empirical evidence as to what shape proposal activity may take this year. Below we present a graph looking at the form of proposal activity based on our company financial records. The graph depicts the volume of proposal activity supported by our company during the past 16 years in the 21st century (2001 – 2016). Our company accounts for a few percentage points of the proposal market, and it is assumed that our business activity is typical.

To make this graph, we averaged revenue during the 4 post-election years – 2001, 2005, 2009, and 2013, and we averaged revenue during the 12 other years in which there was no presidential election.

When the lines on this graph appeared, I was shocked. I expected the post-presidential-curve to be skewed farther to the right. Instead the main differences were a slower start of peak activity — with more ups and downs during peak season – and a greater drop in December. But the basic shape of the two curves is similar.

Will the Pattern be Different under Trump?

In the contractor community there is an expectation that higher spending especially in the DoD will translate to more proposal activity. But at the same time, there is a pervasive fear that the eccentric and unpredictable behavior of the administration will roil the procurement market.

We can now examine the 3 questions posed above in light of the expectations and fears present in the community.

Effect of Very Late Appropriations

A very important indicator of proposal activity is the date at which the appropriations are passed. Often appropriations can be completed in the late fall or winter. In the 21st century we have twice had appropriations drag out to the very late date of early April — but never before until late April / early May.

This is significant because, when appropriations are late, there is not enough bandwidth in the procurement machinery to process all of the programs during the fiscal year. Net effect is that, some procurement dollars are thus pushed away from the services programs and into simple IFB type vehicles such as are often used for equipment buys. Or some services programs are pushed into the fall where they can be competed in the next fiscal year.

Effect of Late Political Appointments

Long-term GOP players assisting in the staffing of the political positions say Donald Trump is the slowest this century in getting these jobs filled. Not having the super grade personnel onboard may or may not affect the progress of RFP releases from one agency to the next. But net net there likely will be some drag on the process because of not having many of the high-level decision makers in position.

Fears of an Impeachment

Contractors and citizens alike find themselves asking the unthinkable – what will be the effect if impeachment proceedings get under way? According to Professional Services Council (PSC) EVP Alan Chvotkin, there would be no effect on FY 2017, because the appropriation dollars are already in place. And the affect on 2018 activity remains to be seen. However, the procurement process continued without catastrophic impact during the impeachment proceedings against Richard Nixon in the 1970s.

What is in the Cards?

![]()

In my opinion present circumstances are leading to the start of the proposal high season in the second half of May. This is a little later than usual, caused mostly by the gross delay in the appropriations. We should see robust activity during the period May through September. And during October and November, we will see higher than usual activity, due to the spill over.

The unanswered question is, will the investigation into possible collusion between the president elect and Moscow affect the progress of the 2018 appropriations?

I appreciate the analysis and thought put into the review. Your is the 1st analysis that has come across my desk and it certainly verifies the more significant slowdown this post election period versus prior ones. The one thing which stands out is the significantly higher element of doubt of (and higher anxiety of the ramifications from) the administration’s intentions, lack of capabilities, inability to staff and maintain staff, and apparent disrespect for our democracy.