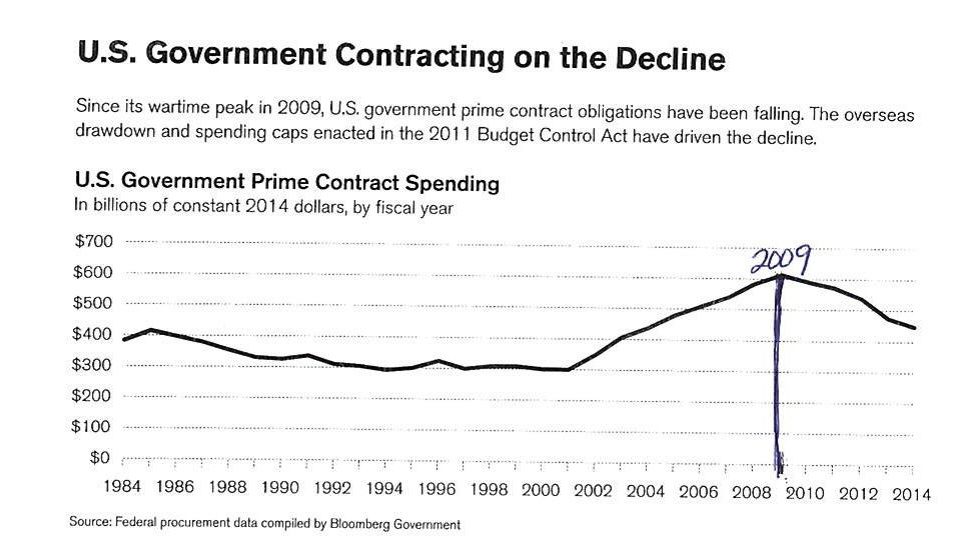

As we all know, the Sequestration has ushered in a new era in contracting. The decline in federal spending has led to a decrease in spending not seen in recent memory. OCI president Russell Smith completed a survey designed to assess what companies are doing to survive on the “new normal” post Sequestration market. Smith surveyed 45 companies: including 15 small, 15 medium, and 15 large businesses. The survey addressed what changes companies have made in their approach to (1) solution development and (2) business development. Surveys were administered on the phone or in person. However, one person responded in writing from Saudi Arabia. Russell Smith presented the survey findings at a meeting of the APMP – NCA on November 18, 2015. Introduction A graph provided by Bloomberg shows the underlying reason for the recent market decline.  Key points on the graph are as follows: 1. Note that the spending in 2001 is about $300 B 2. Spending at the high water mark is about $600 billion in 2009 3. Spending in 2016 has dropped to about $450 B

Key points on the graph are as follows: 1. Note that the spending in 2001 is about $300 B 2. Spending at the high water mark is about $600 billion in 2009 3. Spending in 2016 has dropped to about $450 B

The survey revealed that 70% of companies have changed their solution development methods.

1. Partners – Small businesses have created an army of partners, in order to have a discriminator for the different SOW items they address. 2. Discriminators – Companies widely agreed, you might as well not bid without a discriminator, and you really need both a discriminator and low price. 3. Technology Investment – Some companies are trying to let technology investment be a discriminator. One company purchased a tool into which they can input a complex IT environment. The tool helps make changes without risk. After getting the tool, they started winning task orders. 4. Proposal Libraries – Many companies are finally developing libraries of reusable pieces. 5. Architect SMEs – There is a boom in the SME business with the increased demand for architects to help small businesses put together their solutions. 6. Process – Most companies are attempting to make process improvements, both in their internal processes and in the processes applied to the customer contracts. 7. Focus – This was one of the most commonly heard words in the survey. It means better selection of which contracts to pursue and better selection of teaming partners. How do you get more aggressive price without increased risk? 1. Workforce – Some firms are trying to systematically release expensive employees, while adding younger less costly personnel. 2. Staffing – Many companies are trying for creative staffing solutions. This includes better analysis of requirements; different levels of talent within a labor category; blended rates, etc. Some companies recommend using less staff members but more skilled personnel. 3. Automation – There is an increased push to automate anything that can be efficiently automated. 4. Vet the Solution – More companies are realizing they must present to solution to the customer on a laptop before the RFP and get the customer reaction. What is the secret to more competitive solution? 1. Customer Intimacy – This old wisdom was the most commonly heard answer in the survey. 2. Price – Everyone recognizes that price is usually the key item now. 3. Leverage – Some companies are careful to develop solutions that augment what the customer already has. 4. “Critical Thinking” – One company presents a standard three-hour class to teach program managers. The class is designed to train the managers on how to see from the customer perspective. This lets them do better in helping to develop more responsive solutions. Is it harder or easier to influence the solution now? 1. Harder – Nearly everyone agreed it is more difficult to influence the solution now. 2. How you get in – There was frequent comment that you can get in to see the customer if you have a solution that is clearly efficient and offers a less costly approach. Business Development What is different in the business development / capture / proposal process? 1. Delay – Many commented that the delay now taking place in procurement is making it very difficult to budget business development activities. 2. Change in Focus – The difficulty in getting in to see and influencing the customer is forcing bidders to focus more on upfront work, Black Hat, and, blue team. 3. Selectivity – Nearly everyone is more selective and virtually no one bids long shots now. How has Sequestration affected the quantity and types of personnel working your BD process? 1. Cut Back – About 50% have been forced to cut back on personnel. Cuts have disproportionately fallen on proposal personnel. Companies have made up the difference through using consultants and internal personnel, many of whom don’t know proposal work. 2. Added Personnel – The 20% that have added personnel are the minority who have the cash to invest in their future. These firms have sometimes upgraded their business development personnel.Companies have seen the need to do this in order to have personnel with the skills needed to succeed in solution selling. 3. The Same – About 30% of departments have remained the same. Conclusion The material presented above covers only part of the survey. Those wishing to see the full findings can click here.

Leave A Comment